What’s the Deal with the Debt at Westminster?

An inside look into the financial transition into our new campus and how that affects the school today

The overwhelming amount of debt at Westminster.

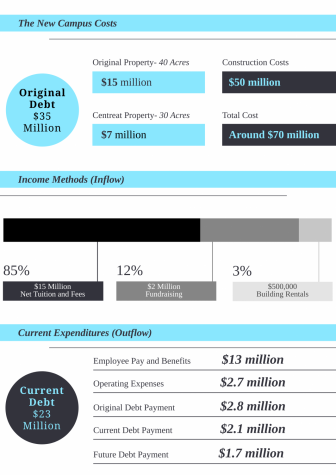

In order to truly understand the financial situation at Westminster, we have to go back to the beginning, when the first ideas of transitioning to the campus we are at today came about. Around 2002, the piece of property that we call home, formally West County Technical School, became available and the head of school at the time, Jim Marsh and other school leaders, felt as though God was calling them to take a look at it, so Westminster put in a bid. They were competing with two other bidders and won the bid. However, now that Westminster owned this 40 acre piece of property, the leadership team was unsure as to what the next steps would be and whether 40 acres would be enough land to accommodate the growing school. However, just at the right time, more land next to the 40 acres Westminster already owned became available.

“The thing that was so unique about this property was that it was 40 acres but right next to it where our baseball fields are was Centreat, owned by Central Presbyterian Church, which was 30 acres. If you looked from a helicopter you would say here’s 70 acres in the heart of St. Louis County, and it was such a good location,” explained Todd Fuller, the Chief Financial Officer at Westminster.

However, Fuller recognizes that it was not easy to buy the additional 30 acres of land, as Westminster had already relied on donations to purchase West County Technical School for around 15 million dollars

“It was kind of a risky move and we weren’t sure what to do because without the land owned by Central Presebyterian Church, we were constrained. Then a donor came forward and donated the money, seven million dollars, to buy the property. Now we had all 70 acres of land and we were ready to start construction,” said Fuller.

With the land acquired, there was still much work to be done, namely selling the Ladue Road campus. However, while the market was not doing well at the time and the first few groups that looked at it weren’t able to pay the full market value because they needed to do some work on the property, the Ladue School District ended up needing to expand that year and bought the building, which gave the school some funds to begin with the expensive project.

“When we moved here this was a 70 million dollar project, and we borrowed 35 million of it. So we borrowed half and we were able to pay half in cash through fundraising and through the sale of our old campus,” continued Fuller.

The concept of borrowing money when purchasing a large piece of property is very normal and works in a similar fashion to when people might buy a house, just on a larger scale. When a person goes to buy a house, most of the time they will not have the amount of cash on hand in the bank to pay the full price of the house up front. So, they take out a loan on the house, usually for around 70-80% of the purchase price. This is called a mortgage, and the borrower pays the bank a certain amount each month or per year depending on their interest rate and the price of the house. This is a similar concept with the school except for on a much larger scale.

“When we moved in and borrowed 35 million dollars, our annual debt payment was 2.8 million dollars a year,” said Fuller.

However, one way to lower that payment of 2.8 million dollars is through the process of refinancing. Refinancing extends the loan and pushes the payment out, which is useful if it is done at a time when the economy is good and therefore interests rates are low, so that the payment is less.

“We refinanced one time which dropped our annual payment from 2.8 million to 2.1 million dollars. We are in the process of refinancing again in March of this year which will lower our payment from 2.1 million to 1.7 million. So you can see that through just refinancing we have dropped our payment over a million dollars which helps the school tremendously,” Fuller explained.

However, refinancing is only a small part of how the business office team manages the overall inflow and outflow of money at Westminster.

“We have three sources of income for the school. Net tuition and fees is around 15 million dollars which is 85 percent of our income. Fundraising is around 2 million dollars which is about 12 percent, and our other income is around 500,000 dollars from building rentals. For our outflow, almost $13 million of that goes to salary and benefits, so things like schools are very employee-centered, and most of our money is going back to the staff. Then, we have operating expenses of 2.7 million dollars which goes to things like our utility bills, building maintenance, etc. Then we pay 2.1 million dollars for our debt payment,” Fuller explained.

How the debt is paid for is often a misconception held by students and even parents who complain about how tuition prices are high because of the debt that Westminster carries. However, this is not the case. The majority of the money that the school receives is used to compensate the teachers and simply keep the lights on.

Also, because Westminster is a private school, some people may assume the opposite and think that we have way too much money and that our inflow is much greater than our outflow. But, by the numbers given above, clearly that is not the case. Todd Fuller provides an explanation for why the inflow and outflow vary from year to year.

“This year we had a drop in enrollment. We had already made staffing plans so we had locked in our employee costs which is the majority of our budget so this year our outflows are going to be a little bit greater than our inflows. Some years it works the other way and we set aside money in a sort of reserve fund and so it’s not a concern in one year,” he said.

A breakdown of Westminster’s finances in graphic form, showing our inflows and outflows.

While this year our outflows are slightly more than our inflows, the board works incredibly hard to balance the budget and keep tuition as low as possible.

“The board works very hard each year, and that’s why the tuition is $17,950 this year instead of $18,000, the board works to save those $50 increments. We’re trying to keep it as low as we can while still having it high enough to cover all of our outflows,” explained Fuller.

When considering the financial aspects of Westminster, it’s important that students, parents, and the community as a whole work to understand the facts and openly ask questions when they are confused as opposed to making assumptions.

“You have to use debt as a tool. I feel like that’s what we’ve done and we’ve got a debt level that’s manageable with our financial model but certainly it does add pressure at times because it is a major part of our outflows. I would want students when they’re thinking about Westminster from a financial standpoint to just ask questions and try to understand it and see the full picture because I think it will make a lot more sense,” concluded Fuller.