Do you ever reach to buy your favorite snack food then notice the price tag? Are you shocked by the criminally high prices? High prices due to inflation have been present ever since Covid-19 struck the world, yet how did they come about and why are these high prices associated with a pandemic?

Covid had a powerful negative impact on companies’ ability to fill demand. When the pandemic reached America, citizens had to remain in their homes for safety. Office buildings were empty, schools were empty, grocery stores were empty. Because of this, companies that would usually offer supplies and services for businesses and public spaces had no customers buying their products.

“Instead of walking through Target… people hopped on their phones and just started shopping. And because of the fact that people were a little antsy about, ‘is it gonna come?’ They were ordering more than they needed at the time to prepare and be extra-ahead of what might or might not happen,” said Brian Maloy, the Business and Communications Department Chair.

“Nobody stressed about toilet paper before Covid, and then as soon as Covid happened [people started stressing]. And a lot of it really wasn’t that people needed more toilet paper, but […] you think about the school’s toilet paper, those giant industrial rolls, people don’t put those in their houses. So manufacturing lines were outfitted to make [toilet paper] for offices and schools and industrial spaces… that’s where people spend most of their time. [Companies] are going to make more toilet paper for those environments and less for houses, and all of the sudden everybody is at home. So it really wasn’t that there wasn’t enough, there wasn’t enough of the right kind,” said Maloy.

Because of all this rapid and unexpected change, prices began to rise. Prices rising is a natural and organic aspect of the economy, but a rapid rise in prices is devastating and harmful. This is where all the talk of “lowering inflation” comes from.

“If one or two things get a little stressful, all of the sudden they all are,” said Maloy.

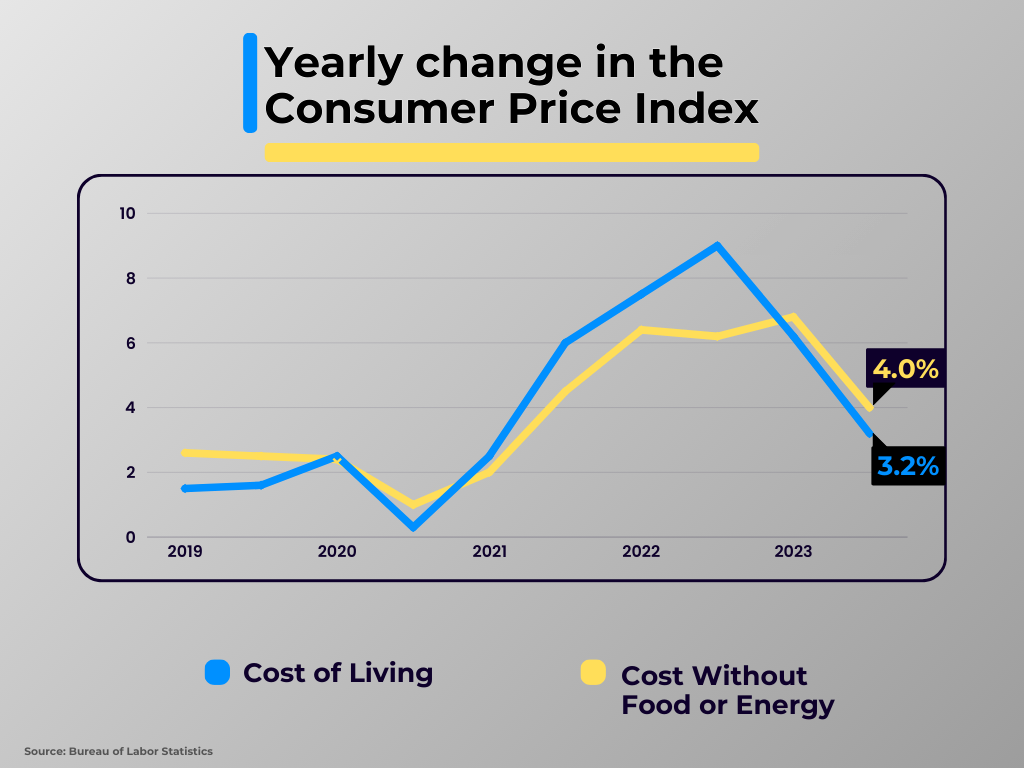

“Inflation is the general raising of prices and most of the time the [federal government] hopes to keep it [at] 2.5, so on average [prices] are going to go up a little each year, but it keeps up with people’s wages and it’s manageable. And in the last few years… we saw food prices and all these things shoot up,” said Maloy.

Because of rising prices mixed with consumers’ wishes to buy more—and the government’s choice to provide Americans with a stimulus check, providing consumers with a little extra cash—average consumerism in America rose, especially as the pandemic began to recede. That’s when prices began leveling out and companies were able to fill orders easier.

According to the Bureau of Labor Statistics, “average annual expenditures increased 3.0 percent between 2018 and 2019 (from $61,224 to $63,036, respectively).” 3 percent is a normal amount of expenditure growth, it coincides with the natural rise of inflation.

However, “average annual expenditures rose by 9.1 percent to $66,928 in 2021, up almost $5,000 from 2020 and up $3,900 from 2019.”

Consumer spending rose three times the normal amount from 2020 to 2021, a drastic increase following the pandemic.

Along with this increase in spending, “from 2018 to 2019, consumer prices for all items rose 2.3 percent. Over that period, food prices increased 1.8 percent, a slightly larger percentage increase than the 12-month increase of 1.6 percent in 2018.”

According to the Forbes Economic Newsletter, “The rate of [Annual Expenditures] peaked at an eye-watering 9.1%, which is the highest level seen since the early 80’s. In order to try to bring inflation back down, the Fed has been drastically raising interest rates. This increases the cost of borrowing, meaning consumers have less money to spend.”

In addition to this sudden change, third party sellers began proffering illicit wares. Often, one person would purchase a large amount of one item, and then sell those items online for many times their original cost.

“I remember seeing people on Facebook Market and Craigslist selling hand sanitizer, regular big bottles of it, that normally would’ve been like seven or eight bucks at the store, for eighty. Obviously that’s morally wrong and at times illegal, but people were taking advantage of it and [going] to buy a shipment of stuff and resell it for way more.” said Maloy.

These drastic changes are slowly settling down. However, even as inflation is returning to its natural rate, prices remain as high as they were.

“Inflation has actually slowed down. We’re back down to the level of maybe 3, 3.5, so we’re a little high but not the 9, 10, 15 that it was. But, the problem is, when inflation raises prices, rarely do prices go back down,” said Maloy.

The only way to lower these prices is to stop purchasing. If companies see that their prices are too high and their customers refuse to pay, they will eventually lower their prices.

“The problem is: people are still buying stuff. Sales are as high as ever, the economy is pretty strong, everyone is just mad. Because prices didn’t come down, they’re mad cause it’s expensive, but they keep buying it. And really the only way to combat high prices is to stop buying stuff,” saif Maloy.

During and following the pandemic, economic problems ran rampant, and the nation is still dealing with the aftermath of those troubles today. While inflation has started to slow in recent months, it may be some time before the economy returns to a pre-Covid state. And even though inflation is receding, prices will remain at their current levels until consumers decide to buy less.